In November, Roseville voters will decide whether to approve a half-cent local sales tax to pay for a new Public Works & Parks Maintenance Facility and License & Passport Center.

For Immediate Release:

June 26, 2024

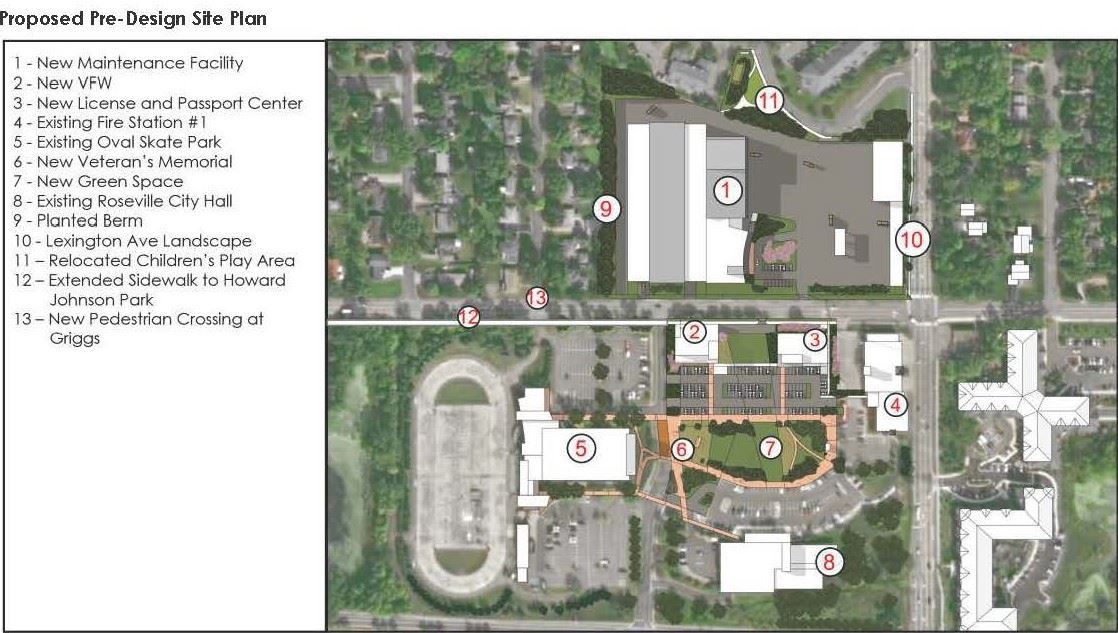

Roseville, Minn. – The City of Roseville launched a new website, InvestInRoseville.org, to inform residents about the proposed $76.9 million plan to build a new Public Works & Parks Maintenance Facility and a License & Passport Center.

“The City’s current maintenance facilities consist of a series of additions to the original building,” said Mayor Dan Roe. “That arrangement has severely limited the flexibility and adaptability of the space - both inside and outside, and the facilities as a result are now only about 70% of the size they should be for our needs.”

As part of the Nov. 5 election, Roseville voters will consider whether to use a half-cent (0.5%) local sales tax to finance the construction of the new buildings. The city developed the new website to inform residents about the projects and provide a way for them to forward questions directly to the city.

The Maintenance Facility is the operational hub for Roseville’s major equipment, water and sewer systems, road work, snow removal, and maintenance of the city’s 32 parks. The current building suffers from a lack of workspace, poor air quality, leaking roofs, and other infrastructure issues. Due to the cramped conditions, the city’s fleet of vehicles is stored bumper-to-bumper, which delays response times for service calls because staff must rearrange vehicles daily to access important equipment.

The Maintenance Facility is the operational hub for Roseville’s major equipment, water and sewer systems, road work, snow removal, and maintenance of the city’s 32 parks. The current building suffers from a lack of workspace, poor air quality, leaking roofs, and other infrastructure issues. Due to the cramped conditions, the city’s fleet of vehicles is stored bumper-to-bumper, which delays response times for service calls because staff must rearrange vehicles daily to access important equipment.

"Our original maintenance facility was built nearly 70 years ago. Even with multiple additions and workarounds, including parking vehicles bumper-to-bumper and renting additional space offsite, we are simply out of room,” said Public Works Director Jesse Freihammer. “This slows response times, consumes staff time, reduces safety, and puts additional wear and tear on the city’s fleet.”

The License & Passport Center is one of the busiest in the state, processing more than 185,000 transactions for driver’s licenses, vehicle tabs, vehicle titles, hunting and fishing licenses, and passports per year. The limited space and poor design of the building create workflow issues and noisy conditions, often making it difficult for staff and customers to communicate.

driver’s licenses, vehicle tabs, vehicle titles, hunting and fishing licenses, and passports per year. The limited space and poor design of the building create workflow issues and noisy conditions, often making it difficult for staff and customers to communicate.

“We are utilizing every inch of the current site and are cramped on both side of our counters,” said Pam Ryan Senden, License and Passport Center Manager. “We need more space to accommodate a better environment for our customers and a more efficient and functional workspace for our employees.”

If approved by voters, the city would invest $64.2 million toward the construction of a new Maintenance Operations Center. The new building would be roughly three times the size of the current facility, designed with efficiency, sustainability, and growing maintenance needs in mind.

Further, the city would invest $12.7 million to build a new License & Passport Center that would nearly double the space of the current building, support more efficient operations, and improve front-counter service. The new center would also be flexible enough to handle a growing number of visitors, which is expected due to the closure of other passport and license centers in the region.

Voters will consider whether to use the local sales tax for each building in separate ballot questions.

Voters will consider whether to use the local sales tax for each building in separate ballot questions.

The City Council proposed a half-cent local sales tax to fund both projects instead of a property tax increase because a sales tax spreads the cost among nonresidents who make purchases in the city and often benefit from city services. According to a study by the University of Minnesota Extension Center, nonresidents would pay almost two-thirds of the buildings’ costs through the proposed local sales tax. That means nonresidents would contribute approximately $49 million toward the construction of both projects.

As proposed by the city, the local sales tax is expected to generate $76.9 million for the construction of the buildings, plus financing costs, over a 20-year period. The sales tax amounts to an extra nickel for every ten dollars spent on certain goods and services. Like the state sales tax, a wide range of essential goods would be exempt from the local sales tax, including food, clothing and prescription drugs.

Over the past six years, Roseville residents have played an important role in the planning process for both projects, providing input through meetings, surveys, and a local task force. The city is committed to informing residents about the proposed projects and the referendum to pay for them.

“We recognize that this is an important community decision,” said City Manager Pat Trudgeon. “That is why we are encouraging residents to visit InvestInRoseville.org to learn more about the projects and share their questions and ideas.”